Cheapest ways to use money overseas in 2022

There are numerous factors to consider when planning to travel overseas. You want to secure your money; you do not want to pay excessive transaction fees, and you also want to be able to make payments easily. You have several options: Use a special travel card, your Visa or Mastercard card, or exchange cash before your trip begins. A range of digital payment options is also available these days, and it is slowly but surely replacing cash in the trading system.

There really is a payment option for every need: from travel cards and digital payment options to international bank cards and many more. Let’s see how you can choose between these options when deciding to travel overseas.

1. Travel cards

A travel card can simply be explained to an inexperienced traveller as a kind of ‟gift certificateˮ on which you pre-load your money. This option allows travellers to make effortless transactions in the destination’s currency and reduces the risk of touring with cash.

Travel cards are a good option if you are on a tight budget, but experts suggest that you still take a credit card with you for emergencies. Also keep in mind that there are often fees involved when you upload or withdraw money. You must also consider the one-time cost of the card, which varies from bank to bank.

Let’s take a look at some of the popular travel cards.

Nedbank Travel Card

You can load up to eight (8) international currencies on the Nedbank Travel Card. The exchange rate is locked-in to ensure stability and combat unexpected transaction costs.

The Nedbank Travel Card automatically detects in which country you are and then uses that country’s currency. It reduces administration and ensures peace of mind while you travel through different countries. You can also use the Nedbank Money App to manage the money on your Travel Card or to buy even more currencies. On top of that, you get an extra bank card just in case something happens to the first one.

Absa Multi-currency Cash Passport and FNB Multi-currency Cash Passport

The Multi-currency Cash Passport is similar to Nedbank’s Travel Card. However, you can only load up to seven (7) currencies on a Multi-currency Cash Passport.

Just like with the Travel Card, a predetermined exchange rate protects you against fluctuations and you can manage your funds on your bank’s app. You can also link an optional second bank card or bonus card to the funds in the account.

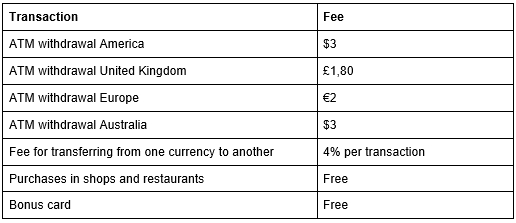

Because both FNB and Absa’s Multi-currency Cash Passport are offered by Mastercard, they do not differ much from each other. The starting price depends on your bank. You can view other fees in the table below:

Holders of an Absa Multi-currency Cash Passport can take advantage of their group travel campaign promotional offer between 1 April 2022 and 30 November 2022. It has the following benefits:

- If you recharge with R5 000 to R10 000, you will receive a voucher of R100.

- If you recharge with R10 001 to R15 000, you will receive a voucher of R200,

- If you recharge with R15 001 or more, you will receive a proof of R300 once.

Standard Bank Shyft Global Wallet

Standard Bank’s Shyft Global Wallet works with a free app on your smartphone, but you can also order a physical card for a fixed fee of R100. This option is available to users of all banks and one of their biggest benefits is that anyone can use the bank’s free forex app anywhere in the world.

Users can easily deposit enough rands with an electronic transfer into their Shyft account. You can load up to five (5) currencies into different electronic wallets. If you use this option, you can also make free Shyft-to-Shyft payments. Transaction fees are determined by the value of the currency you purchase.

1. Debit and credit cards

The most hassle-free option is to simply use your existing bank card for withdrawals and payments. Remember to notify your bank if you plan to use your card overseas. Even if you choose to use cash or a travel card, it is still a good idea to take your existing bank card with and notify your bank.

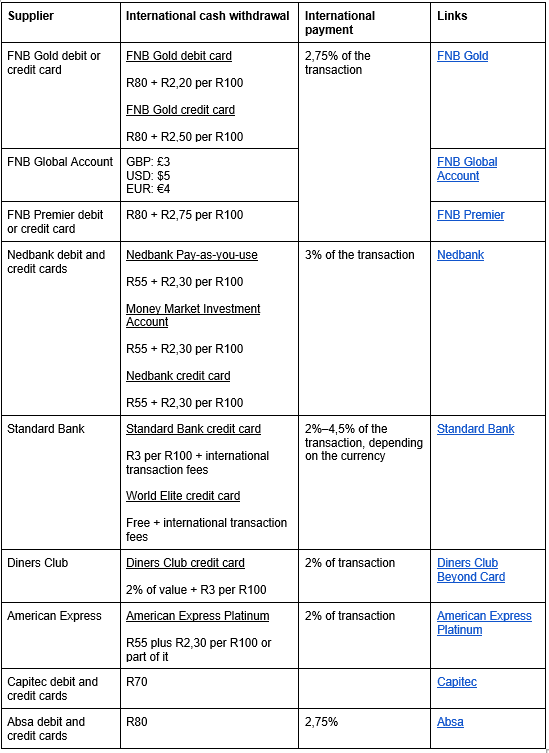

The table below shows the international withdrawal and transaction fees for 2022. It indicates what it will cost you to withdraw cash at a Visa or Mastercard ATM and how much a transaction with your card will cost. If you exchange rands for another currency, an exchange fee will be charged. For example, if the dollar costs R16 and the exchange fee is 2,75%, you actually pay R16,44 for every dollar.

Tip: When making a payment overseas and being asked if the transaction should be recovered in rand or in the local currency, always choose the local currency rather than rand because it is always the cheapest option.

1. Cash

Exchanging your rands in cash for another currency means knowing exactly how much commission you are paying and at what exchange rate you exchanged your money. This makes it easy to calculate what products overseas will cost you because you can work with the same exchange rate all the time. Cash is also ideal for places where there is not an ATM around every corner. But cash should never be your only option; always take another form of money with you for unforeseen events.

Tip: Make sure you exchange cash before going to the airport. You often pay more commission for exchanges at airports than at other bank branches.

2. Digital payment options

The use of cash is no longer as widely accepted as in the past. Sellers and consumers have made a headway during the pandemic over the past two years and nowadays prefer digital payment methods over cash. The move was probably fuelled by fears of the spread of germs on banknotes – a fear that is likely to remain.

This move can even be seen in South Africa where tourist attractions are increasingly accepting less cash and preferring options such as SnapScan and Yoco. In a recent study, Yoco, a payment service provider, found that the number of businesses that do not longer accept cash increased from 8% to 32% after the pandemic.

We would therefore not suggest that you rely on cash only when traveling overseas. The cash option also carries a greater risk that your money may be stolen or that you may lose it.

In addition to travel cards, debit and credit cards, cash and the above-mentioned digital options, tourists also have the option to use an app on their smartphone. Below we discuss a few such apps.

Apple Pay

One of the best-known digital payment options is Apple Pay. This option allows you to redeem your bank cards at home or at your hotel and make local and international payments with the free app. However, you will need data for transactions, and you will still have to pay the standard bank fees.

With this option, you can also easily locate your digital bank card and airline tickets in the Wallet app on your phone.

Most banks, including Absa, FNB and Standard Bank, give users access to Apple Pay.

Samsung Pay

Samsung Pay also offers an all-in-one payment option. It is available in 24 countries, and users can use it anywhere in the world where their bank allows it. You can load all your American Express, MasterCard and Visa debit, check and credit cards in association with Absa, Standard Bank, FNB, RMB and other banks on Samsung Pay.

Crypto

Digital currencies like cryptocurrencies allow travellers to evade various fees, but many people still feel very sceptical about it. However, if you know your story, it can be beneficial because the rand is so weak against other currencies and because you can avoid bank charges.

Some cryptocurrencies like Bitcoin do not need to be converted and there are few extra fees involved. Buyers and sellers can use payment gateways as facilitators. This gives the seller the option to accept cryptocurrency as payment and then exchange it for their country’s currency.

Precaution is paramount in any form of digital payment. Make sure you have mastered the platform before going overseas.

So, what is the best payment option while you travel?

It will depend on your needs and how much you are willing to pay for convenience. It remains your responsibility to compare price structures, advantages and disadvantages and make your choice based on that.

Some factors you need to consider are security, convenience, and how many transactions you budget for.

Cash may not be so popular anymore, but it still would be wise to take some banknotes with you. If you know that you are prone to overspending, a travel card may be the best option for you because you can avoid extra fees with it. For those who do not mind paying a little more per transaction and would rather avoid the initial fee of a new card, your existing credit card is the best option.

Then, of course, there is one last option: to open a bank account in the country you want to travel to and transact with a local card.

Whatever your final choice, remember to draw up a budget and include the hidden fees. Bon voyage!

Share on

Latest articles