Did you know that your donation can be a tax benefit?*

By Wimpie Vogel

With the first month of the year already behind us, the tax year is quickly nearing its end in February. For most of us (the salary drawers) there is not much left to do about our tax accountability for the 2024 tax year.

One of the few remaining options is to donate to a public benefit organisation (PBO) that has been authorised by the South African Revenue Service (SARS) to issue Section 18A certificates.

Section 18A of the Income Tax Act 58 of 1962 determines that bona fide donations that are made to certain institutions may be deductible from a person’s taxable income. For ordinary people, this deduction is limited to 10% of their taxable income.

It is important to remember the following:

- Section 18A clearly states that it must be a bona fide donation. If there is any counter performance for the donation, it does not qualify as a donation. Therefore, the person (donor) must donate the money (i.e., give it away) and may not receive any benefit from this act (except, of course, the Section 18A certificate).

- It may be any kind of donation (cash or goods) that is physically paid or transferred.

How does it work?

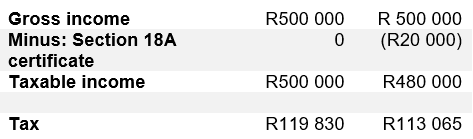

For this scenario, we consider a man who has earned R500 000 for the year and who made a donation of R20 000 to an approved organisation. Please note: The full R20 000 is deductible because it complies with the 10% rule. If there had been a part that was more than the 10%, it would have rolled over to the next tax year.

In this scenario, the man pays R6 765 less tax to SARS.

The last thing to remember is that the onus for any deductions is on the taxpayer. Therefore, ensure that you have the Section 18A certificate (with the valid PBO and NPO numbers) as well as proof of payment.

The receipt as well as the payment must be dated in the tax year. If this sounds like an option, you will have to hurry and make your donation before the end of February!

A donation to AfriForum can possibly decrease your tax accountability.

Get involved!

Join

Become a member of AfriForum by clicking here.

*

Donations

You can use GivenGain to donate easily, safely and online. It is especially easy for international and local supporters who would like to make a one-off or recurring donation.

Contact us with any enquiries or for more information.

*This tax benefit is only available to people who pay tax in South Africa.

Photo: Micheile Henderson – Unsplash