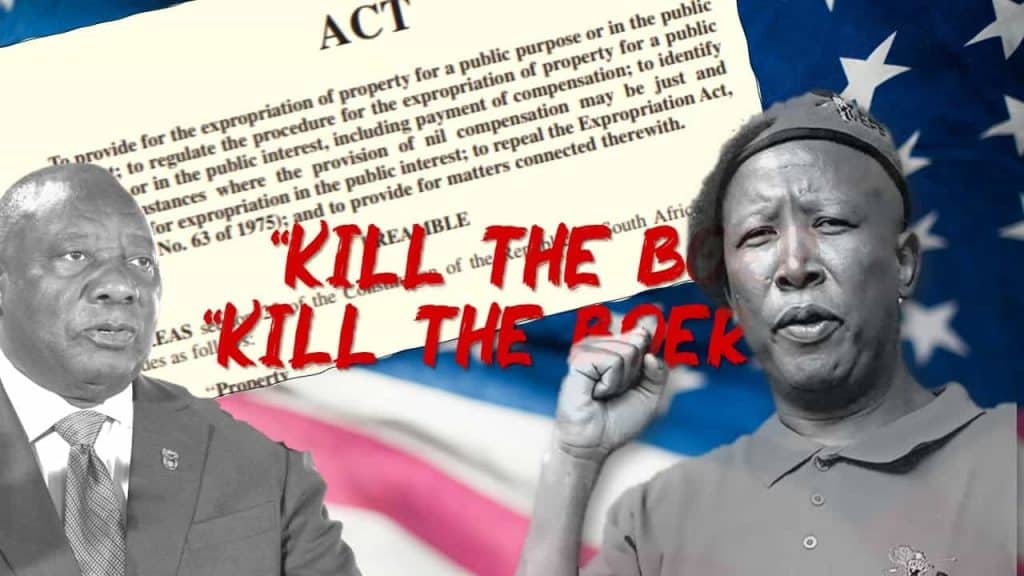

International estate planning more relevant than ever for offshore investors

The current political uncertainty and lacklustre local equity market performance have created an increased focus on offshore investments over the last few years. Investing offshore allows you to spread your investment risk across different economies, regions, sectors and securities, and to find more opportunities.

However, investing in these offshore jurisdictions might have significant implications for your estate, and requires consideration of all the constantly changing regulatory requirements when putting an estate plan in place.

The value of estate planning

Offshore estate planning is about ensuring that you and your family’s offshore wealth is in good hands in the event of your death, and also that your estate will be in an optimal tax position. It starts with having a will in place in South Africa that will cover your worldwide assets. With PSG’s offshore investment options, there is no need to have a separate offshore will or to appoint another executor offshore (the so-called probate process).

Impact of investing in different jurisdictions

A client may be subjected to death taxes in different jurisdictions, referred to as situs tax, depending on the jurisdiction he is invested in, as well as where the asset is domiciled or registered.

The brilliant Albert Einstein said: ‘The hardest thing to understand in the world is income tax.’ If situs tax was around back then, I am sure he would have echoed the words of Margaret Mitchell, ‘Death, taxes and childbirth! There’s never any convenient time for any of them.’

The purpose of this article is not to give general advice, but to ensure that you are informed of the tax impact on estate planning. Although we have communicated on the issue of situs tax in a previous newsletter, we want to ensure that all clients that hold listed shares in their personal capacity in the United States (US) and the United Kingdom (UK) consider the implications of this tax carefully, especially for their estate planning.

This article does not provide thorough detail on all aspects of situs tax, nor does it explain the implications in detail. The aim is rather to further enlighten you on this issue.

Common Reporting Standard (CRS)

Revenue services worldwide are moving towards closer cooperation by sharing financial information. The ‘Common Reporting Standard’ (CRS) is formally known as the Standard

What is SITUS TAX?

Situs tax is levied on shares (and certain other assets) that are held in listed companies in predominantly the United States and the United Kingdom. The exemptions for residents of these countries are very favourable, but for non-residents the tax implications of death can be less favourable.

Although there are other jurisdictions that also levy situs tax, this article will primarily focus on the US and the UK because of our portfolios’ exposure in those two countries.

In the United Kingdom

In the UK this tax is known as Inheritance Tax (IHT). The exemptions for non-UK residents living in South Africa are quite favourable, to the extent that an amount of more than R5,6 million (at R17,34 to the pound) can be invested in UK shares by an individual before situs tax will become applicable. The exemption is £325 000. If a spouse is the sole heir of the shareholder, no tax will be levied on the death of the first to die and this exemption transfers to the spouse. At the spouse’s death the exemption will then be £650 000. The maximum tax rate in the UK is 40%.

In the United States

In the US this tax is called Federal Estate Tax (FET). The exemption for non-residents is only US$60 000 and FET is payable on the death of an individual, irrespective of whether the spouse is the sole heir.

This means that an investment of more than R780 000 (at R13 to the dollar) in US shares will attract situs tax on a sliding scale. The maximum tax rate in the US is also 40%.

What is the relation between foreign situs tax and our estate duty?

Any situs tax paid will be taken into account when estate duty is calculated. No estate will be subject to double taxation. However, the real issue is that the rate of situs tax offshore can be up to 40% in comparison with the current estate duty tax rate of 20% levied in South Africa.

What is the risk?

The risk is that the estate of an individual who owns listed shares in the US and the UK may end up being taxed up to 40% situs tax on their death. This risk requires individual consideration seeing that each investor’s situation is unique.

Can situs tax be avoided?

It is possible to invest through a structure where situs tax will no longer be applicable. If the owner of the offshore shares is not the individual – for example, where the investment is made through (1) an offshore unit trust fund, or the shares are held within (2) an offshore endowment policy, or through (3) an offshore trust, or (4) an offshore trust and company structure – no situs tax will be payable.

Will there be cost implications to change the portfolio?

This will depend on each individual’s situation. When ownership of an investment is changed, it will trigger a capital gains event and a calculation must be done to determine whether capital gains tax will be payable.

Exposure in our Global Equity Portfolio

Our Global Equity Portfolio, for example, currently has approximately 65% exposure to US shares. This means that when your total portfolio value exceeds R1 200 000, your investments will reach a point at which it will be subjected to situs tax. This is no cause for alarm, but it does mean that the circumstances need to be evaluated.

The way forward

If you are potentially affected by situs tax in your portfolio and we haven’t yet been in touch, we will contact you shortly to have a discussion regarding your unique situation and the options available for consideration as part of our holistic financial planning process.

PSG Silver Lakes, George Central and Mossel Bay Diaz

Tel: 086 134 8190/ 082 415 0318

Email: anton.prinsloo@psg.co.za

Share on

Latest articles